It was all started in 1985. The time was the inaugural flight of what was destined to become the Middle East’s biggest Airline i.e. Emirates. The airline is a subsidiary of Emirates Group which is completely owned by the Government of Dubai. It is known to be the largest airline of the Middle East that operates 3400 flights per week.The company has created a strong brand name as a leader in the aviation industry more specifically because of its rapid growth and service excellence.

Following is a brief marketing plan of the company that explains each aspect as how it grew the ongoing challenges, its competitors and the strategies that have helped the company to sustain itself over the years. Moreover, the company’s current financial growth is mentioned that has made the Emirates Airlines at the top leading position.

The Challenges

The company has been going through incredibly challenging times such as rising fuel prices, weak demands and increase in government taxes. In times like this, the company has to foster real leadership quality and experiences.

The Situational Analysis

Emirates Airline has developed in scale and stature as a globally influential travel and tourism company known to the world for its commitment and dedication in every aspect of the business.

In 2001, the company announced the largest ever order for the Boeing 777 Family of aircraft in a deal worth of USD $9 billion.

In the financial year of 2013/2014, the company carried 44.5 million passengers and 2.25 million tons of cargo. The company’s goal is to carry many million more passengers by expanding into more international destinations. The company is predicted by Boston Consulting group to become the world’s largest airline by 2015.

Customer Analysis

Emirates have repositioned its market by formulating a global marketing strategy that represents its customers as globalists. The company launched a global multimedia campaign named as” Hello Tomorrow” that aims to position the airline as enabler of global connectivity and significant experiences.

Competitor Analysis

Etihad Airways: It is the national carrier of the United Arab Emirates and carrier of the region of Abu Dhabi. The company currently operates a fleet of 54 aircrafts and shares a code agreement with 23 of the world airlines i.e. Jet Airlines, Malaysian Airlines, American Airlines etc. The company’s main business line is in carrying out an international air transportation and also Etihad Crystal Cargo that handles all the international transportation of goods.

Emirates hold the same market value as Etihad but it stand out for its brand image in the minds of the consumers for the past 25 years.

Collaborators

Joint Ventures:

With Qantas Airways that has replaced Singapore with Dubai as a stopover to London.

Subsidiaries:

The Company has got over 6 subsidiaries which include Emirates Holidays, Arabian Adventures, Emirates tours, Congress Solution International etc.

Climate

Pest Analysis

Political and Legal Environment:

The Company has signed an agreement with countries in Asian Pacific and others to allow them to facilitate trade. Since 2000, the trade has been favorable for the company as these affirmations have opened up the Emirates to the whole world.

Economic Environment:

An increase in the fuel prices creates hurdles for the company to generate more profits. If the economy of the country is running well, the per capita income of an individual will increase and will be eager to travel via Emirates.

Social and Cultural Environment:

The company has maintained its social and cultural diversity by offering its airline services to various societies, religions and traditions who are all interacting at one place. The company’s workforces also try to adapt itself according to the social/cultural environment they operate in.

Technological Environment:

A development in technology will help the company to improve aircrafts facilities and fuel in order to reduce the environmental impact of the Emirates operations. The company spends over USD 4 billion on bio fuel that are technically safe and cost effective. Moreover, the company bought new Airbus A350-XWB, Boeing 747-8F to remain the competitive advantage.

SWOT Analysis

Strengths

• One of the member of Arab Alliance.[sky]

• Strong support of Dubai Government.

• Known as one of the world’s best airline in the industry.

• Most preferred airline.

• Customer loyalty.

• Covers almost 72 countries in 6 continents.

• Skilled workforce.

Weaknesses

• Intense competition makes the market growth limited and high cost of living up to the benchmark standards.

• Fares are higher than other international airlines.

• No global international alliance.

Opportunities

• Providing a brand new fleet leverage that can improve the customer’s confidence in the airline.

• More international destinations can be covered.

Threats

• Fierce competition in the Middle East region.

• Increase in fuel prices.

• Change in the government policies and regulations.

Market Segmentation Strategies

Market Penetration Strategy

Emirates have taken advantage of this strategy by lowering down its rate for the following reasons:

• To retain and boost the market share of the company.

• In order to protect the market dominance of Emirates Airlines.

• Restructuring the mature market segment.

• Increase usage of the existing passengers.

Market Development Strategy

The company has now expanded its airline service into various international destinations. More recent example is of Shanghai where the company offers the passengers a chance to stopover at the epicenter of China’s political and cultural activities.

Product development Strategy (Private Suite)

The company keeps on introducing new high quality first class private lounges to attract the business segment. The premium class private suite is filled with personal storage, coat cabinet, desk and individual mini bar.

Other market segmentation strategies include related diversification (low cost carriers), differentiation strategy and so on.

Marketing Mix 4p’s

Product:

The Company provides intangible service to the passengers and also holiday packages, hotel services and car rental to some countries. The product strategies include: Product development, Product Extension Etc.

Price:

The pricing strategies depend on the class, season and the location where the passenger is flying by. For instance, Emirates are cheaper than Virgin Airlines for a flight to Dubai. For a business class, they offer an award winning service i.e. lounge access, 40kg baggage allowance etc.

Place:

The Company’s main location is in Dubai, UAE. They usually operate in 3000 flights per week from its hub to Dubai International airport. Channels of Distribution includes website, travel agent and by telephone as well.

Promotions:

Emirates usually promotes its company by launching different ad campaigns. The “Hello Tomorrow” campaign is a remarkable example of bringing people closer, connected and encourage them to make a positive impact on society.

Short/Long Term Projections:

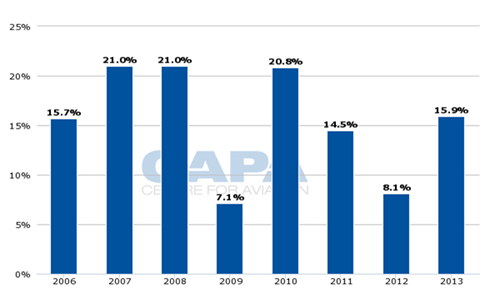

Emirates Annual Passenger Numbers

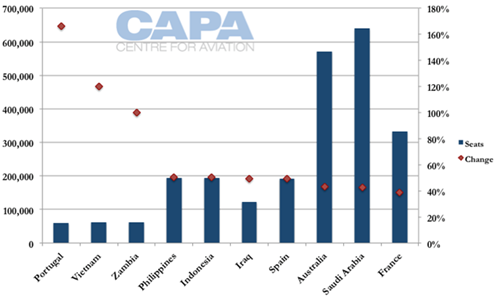

Top 10 countries in emirates network ranked on percentage growth in 1h2013/2014 measured with 1h2013/2014 seat capacity.

The growth at Emirates is still two steps forward and just a little backward in Syria’s airline services suspension due to its political deteriorating situation.

Conclusion

The successful performance of Emirates Airline suggests that it will continue to heighten the company’s market presence in the future as well.

Reference

http://www.ey.com/GL/en/Services/Strategic-Growth-Markets/Exceptional-July-2013—Emirates-Airlines

http://www.bi-me.com/main.php?id=52479&t=1

http://www.mbaskool.com/brandguide/airlines/534-emirates.html